Binomial model put option

In the financial world, the Black-Scholes and the binomial option models of valuation are two of the most important concepts in modern financial theory. Both are used to value an optionand each has its own advantages and disadvantages. In this article, we'll explore the advantages of using the binomial model instead of the Black-Scholes, provide some basic steps to develop the model and explain how it is used. Multiple-Period View The binomial model enables a multi-period view of the underlying asset price as well as the price of the option.

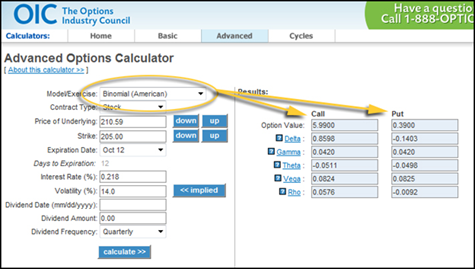

In contrast to the Black-Scholes model, which provides a numerical result based on inputs, the binomial model allows for the calculation of the asset and the option for multiple periods along with the range of possible results for each period see below. The advantage of this multi-period view is that the user can visualize the change in asset price from period to period and evaluate the option based on making decisions at different points in time.

For an American optionwhich can be exercised at any time before the expiration datethe binomial model can provide insight into when exercising the option may look attractive and when it should be held for longer periods.

By looking at the binomial tree of values, one can determine in advance when a decision on exercise may occur. If the option has a positive value, there is the possibility of exercise, whereas if it has a value less than zero, it should he held for longer periods. Transparency Closely related to the multi-period review is the ability of the binomial model to provide transparency into the underlying value of the asset and the option as it progresses through time.

The Black-Scholes model has five inputs:. When these data points are entered into a Black-Scholes model, the model calculates a value for the option, but the impacts of these factors are not revealed on a period-to-period basis.

Option Pricing - Binomial Models

With the binomial model, one can see the change in the underlying asset price from period to period and the corresponding change caused in the option price. Incorporating Probabilities The basic method of calculating the binomial option model is to use the same probability each period for success and failure until option expiration.

However, one can actually incorporate different probabilities for each period based on new information obtained as time passes.

The binomial model allows for this flexibility; the Black-Scholes model does not. In our example, there are two possible outcomes for the oil well at each point in time. A more complex version could have three or more different outcomes, each of which is given a probability of occurrence. To calculate the returns per period starting from time zero nowwe must make a determination of the value of the underlying asset one period from now.

In this example, we will assume the following:. The formula for this calculation is [max P-K ,0]. You can now see that if the probabilities are altered, the expected value of the underlying asset will also change.

If the probability should be changed, it can also be changed for each subsequent period and does not necessarily have to remain the same throughout. The binomial model can be extended easily to multiple periods. Although the Black-Scholes model can calculate the result of an extended expiration datethe binomial model extends the decision points to multiple periods. Uses For The Binomial Model Besides being used for calculating the value of binomial model put option option, the binomial model can also be used for projects or investments with a high degree of uncertainty, capital-budgeting and john carter options trading decisions, as well as projects with multiple periods or an embedded option to either continue or abandon at certain points in time.

One simple example is a project that entails drilling for oil. The uncertainty of this type of project arises due to the lack of transparency of whether the land being drilled has any oil at all, the amount of oil that can be drilled, if oil is found and the price at which the oil can be sold once extracted.

The binomial option model can assist in binomial model put option decisions at each point of the oil drilling project. For example, assume we decide to drill, but the oil well will only be profitable if we find enough oil and the price of oil exceeds a certain amount. It will take one full period to determine how much oil we can extract as well as the price of oil at todd brown forex trader point in time.

After the first period one year, for examplewe can decide based on these two data points whether to continue to drill or abandon the project. These decisions can be continuously made until a do wash sale rules apply to day traders is reached where there is no value to drilling, at which time the well will be abandoned.

The Bottom Line The binomial model allows multi-period views of the underlying asset price and the price of the option for multiple periods as well as the range of possible results forex managed account reviews each period, offering a more detailed view. While both the Black-Scholes model and the binomial model can be used to value options, the binomial model simply has a broader range of applications, is more intuitive and is easier to use.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

The Binomial Model for Pricing Options

Breaking Down The Binomial Model To Value An Option By Arturo Neto Share. Some of the basic advantages of using the binomial model are: The Black-Scholes model has five inputs: Risk-free rate Exercise price Current price of asset Time to maturity Implied volatility of the asset price When these data points are entered into a Black-Scholes model, the model calculates a value for the option, but the impacts of these factors are not revealed on a period-to-period basis.

In this example, we will assume the following: Price of underlying asset P: These decision-making tools play an integral role in corporate finance and economic forecasting.

Despite the fancy-sounding name, you already understand the Binomial Distribution, and you can use it to make money. Mathematical or quantitative model-based trading continues to gain momentum, despite major failures like the financial crisis ofwhich was attributed to the flawed use of trading models. Want to build a model like Black-Scholes?

Here are the tips and guidelines for developing a framework with the example of the Black-Scholes model. Find out how you can use the "Greeks" to guide your options trading strategy and help balance your portfolio. The Black-Scholes model is a mathematical model of a financial market. From it, the Black-Scholes formula was derived. The introduction of the formula in by three economists led to rapid Learn about the Black-Scholes option pricing model and the binomial options model, and understand the advantages of the binomial Learn why implied volatility for option prices increases during bear markets, and learn about the different models for pricing Learn how implied volatility is used in the Black-Scholes option pricing model, and understand the meaning of the volatility Learn how the strike prices for call and put options work, and understand how different types of options can be exercised Understand the difference between financial forecasting and financial modeling, and learn why a company should conduct both Holding an option through the expiration date without selling does not automatically guarantee you profits, but it might An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.