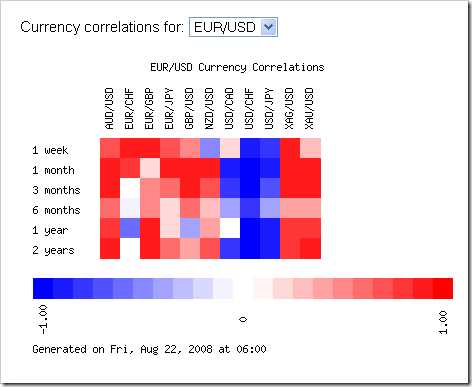

Forex correlation pairs table

Online Trading Academy has its roots in the largest trading floor in the Western US, founded in by Eyal Shahar. Independent traders needed training to be successful in their investments, and soon a teaching model was born.

Forex Correlation | Myfxbook

Enriching lives worldwide through exceptional financial education. This week we will explore a couple more interesting things about forex correlations. How would you like to be able to double check a breakout past supply or a breakdown past demand? Occasionally we might notice that a break is quickly retraced and the move reverses. WHY fake breaks happen is for the conspiracy theorists out there; just understand that they do happen.

So, how could we use correlations to determine if the break is real or not?

The horizontal lines mark the low price lines, while the first vertical line marks when they were all lined up. The second vertical line and small blue circle marks when the EURUSD had a fake break to the downside. However, in this instance they would have been quickly stopped out. Understanding the correlations between these three currency pairs would have kept the more knowledgeable trader from taking the short trade.

Here is the thought process. A slightly more aggressive trader will still take the short trade, but perhaps trade a smaller position size.

Forex Correlation Heatmap and Correlation Table - MarketPulseMarketPulse

In this chart you can see that we have the USDJPY, GBPJPY, and the GBPCHF. With vertical line marked 1, each currency pair had hit a high and retraced. At vertical line marked 2, the USDJPY attempted to break out to the upside at the blue circle.

However, both other currencies with such a high correlation! You can plainly see that the USDJPY could not hold those prices. At the vertical line marked 3, the USDJPY broke out again but check out where the other two currency pairs are! Both have already broken past their previous highs and were trending higher-perhaps think of it as those two are dragging the USDJPY after them. As far as an Online Trading Academy core strategy play, how could you use this information?

When the other pairs break to the upside, look for a quality demand zone to go long the lagging pair. On the flip side, when the other pairs break to the downside look for a quality supply zone to short the lagging pair.

One last tidbit on using these charts, imagine your currency pair is approaching your profit target. What might you consider doing if the other, correlated pairs were still running in your direction? Could they keep dragging your trade even past your profit target? Would moving your profit target even further out make sense? That is certainly possible.

Learning how to manage your winning trades as their correlated pairs are still running can definitely put more pips in your pocket! Please also understand that the correlations between currency pairs can and do change.

For example, the EURUSD and GBPUSD would be expected to have a pretty strong direct correlation over time. However, when measured over the past month their correlation has dropped to a -.

One must not rely on unreliable data when using correlations! There are many resources on the internet as far as how to calculate these correlations, plus many of your platforms will offer them as indicators. Please check the correlation figures and make sure they are compatible with the time frames that you plan on trading. Nor would I use a high one day correlation if I were planning on a long term position trade.

So there you have it, traders! Use the correlations to help confirm if a breakout is real or not, and also help to manage your winning trades. As the correlations change over time, keep in mind that what worked last year might not work this year.

Forex Market Pair Correlations | Best Currency Pairs to Trade

Celebrating 20 Years Transforming Lives for Two Decades Online Trading Academy has its roots in the largest trading floor in the Western US, founded in by Eyal Shahar. Learn Programs Core Strategy Extended Learning Track Mastermind Community Specialty Courses Assets Stocks Forex Futures Options. Lessons from the Pros Calculators Financial Education Center Power Trading Radio Free Online Trading Courses.

Our Company Instructors Reviews News Join Our Team. Subscribe to our award-winning Lessons from the Pros Newsletter. Lessons From The Pros Main Contributors Archives FAQ Free Half-Day Class August 4, Stop Loss: Professional Losing Take Advantage of the Trend Reversals Currency Pairs and Correlations, Part 2 Options — More on Option Spreads Futures Trading Rules: Cool Heads Will Prevail What is Your Compelling Reason to Stock Trade?

Selling a Tenant Occupied Rental Property Issue Index Archive. Home Resources Lessons from the Pros Currency Pairs and C Forex August 4, Currency Pairs and Correlations, Part 2 Rick Wright Instructor.

Disclaimer This newsletter is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader.

The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results. Reprints allowed for private reading only, for all else, please obtain permission.

Forex Correlation - Mataf

Network My OTA OTA Real Estate OTA Tax Pros. Company Careers Franchising Reviews Staff. Legal Privacy Policy Risk Disclosure. Support Contact Us Site Map.