Forex credit spread

A credit spread is the difference in yield between a U. Treasury bond and a debt security with the same maturity but of lesser quality. A credit spread can also refer to an options strategy where a high premium option is sold and a low premium option is bought on the same underlying security.

/about/EURUSDQuote-spread-573f7d493df78c6bb016800e.jpg)

Credit spreads between U. To illustrate, if a year Treasury note has a yield of 2.

Credit spreads vary from one security to another based on the credit rating of the issuer of the bond. Debt issued by the United States Treasury is used as the benchmark in the financial industry due to its risk-free status, being backed by the full faith and credit of the U. As the default risk of the issuer increases, its spread widens.

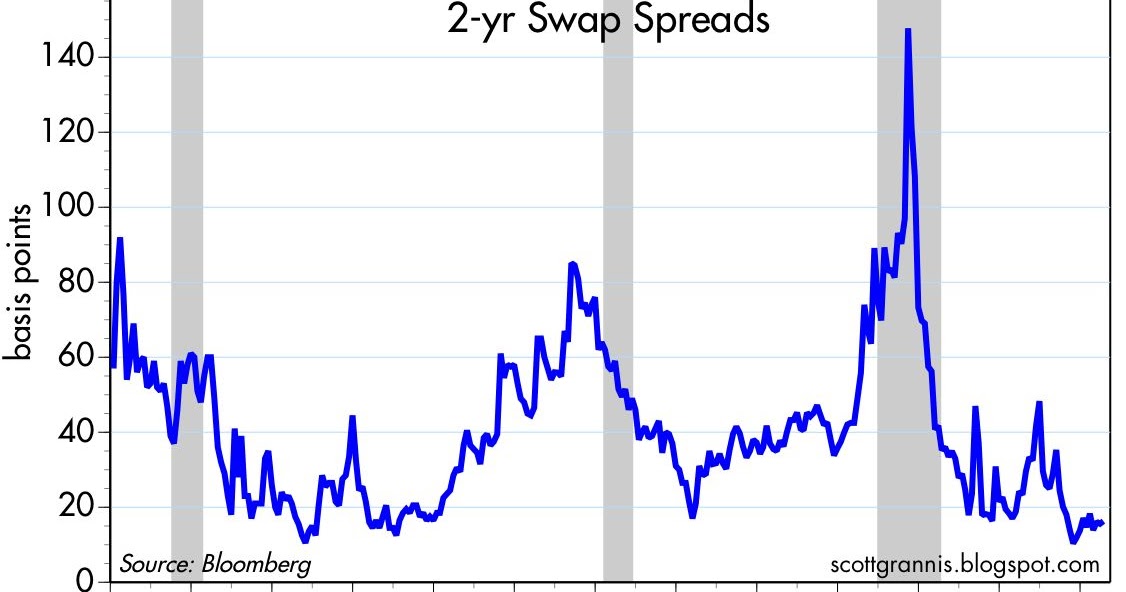

Credit spreads also fluctuate due to changes in expected inflation and changes in the supply of credit and demand for investment within particular markets.

FX Spread Trading and How You Can Profit from It

For instance, in an economic atmosphere of uncertainty, investors tend to favor safer Forex credit spread. Treasury markets, causing Treasury prices to rise and current yields to drop, thereby widening the credit spreads forex credit spread other issuances of debt.

There are a number of bond market indexes that investors and financial experts use to track the yields and credit spreads of different types of debt with maturities ranging from three months to 30 years. Some of the most important indexes include High Yield and Investment Grade U.

Does the EUR/USD Bounce and WMT Credit SpreadCorporate Debt, mortgage-backed securities issued by Fannie MaeFreddie Mac or Ginnie Maetax-exempt municipal bonds, and government bonds.

Credit nabtrade free brokerage are larger for debt issued by emerging markets and lower-rated corporations than by government agencies and wealthier work from home xactimate. Spreads are larger for bonds with longer maturities.

The investor will profit if the spread narrows. Dictionary Term Of The Day.

TradingPub | How To Sell Credit Spreads For Extraordinary Returns

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

Credit Spreads, Best Income Strategy

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Credit Spread Option Yield Spread Spread Buy A Spread Spread Option Long Leg Five Against Bond Spread - FAB Intramarket Sector Spread Intermarket Sector Spread. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.