Stock based compensation expense tax deductible canada

Carla Hanneman and Lyle Teichman.

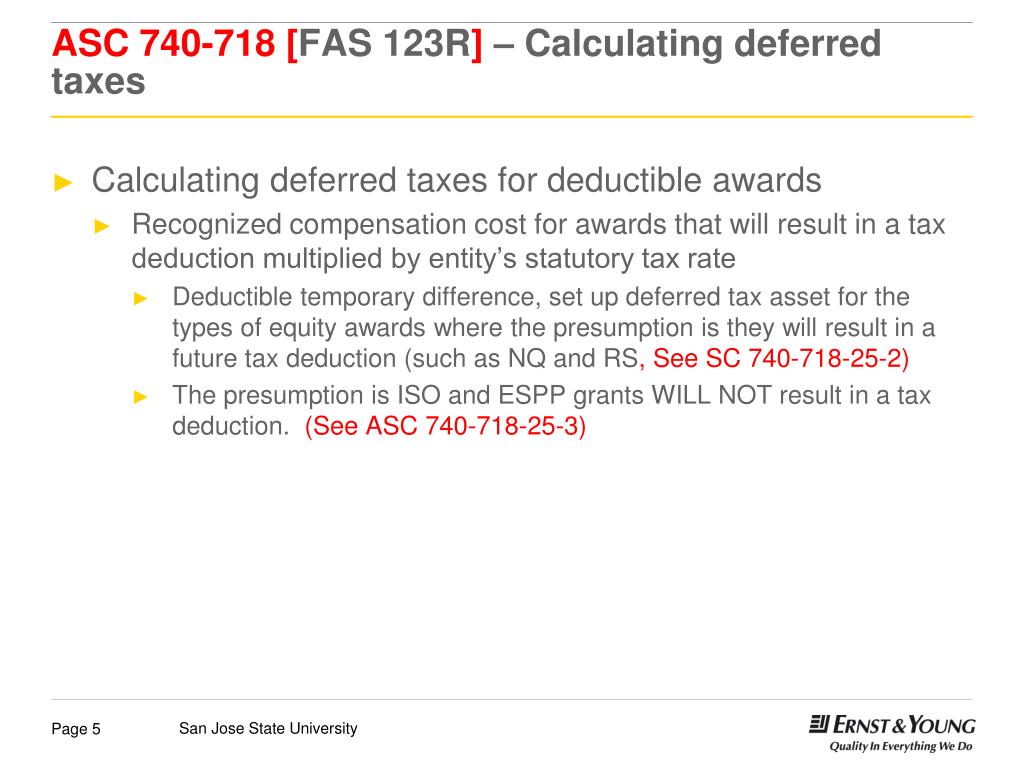

Equity-based incentive plans have in recent years become a common component of the compensation package for executive employees in Canada. Employers often design the plans in such a way as to enable the employer to claim a tax deduction for the value of the equity-based compensation. In the case of treasury shares issued under stock bonus plans, the Canada Revenue Agency CRA has historically taken the position that the value of treasury shares issued under such plans is not deductible by the employer for tax purposes.

What are the international tax and transfer pricing considerations for equity-based incentive compensation? | Insights | DLA Piper Global Law Firm

However, a recent decision of the Tax Court of Canada allowed the employer to deduct the fair market value of treasury shares issued to executive employees under a discretionary stock bonus program. Section 7 of the Income Tax Act Canada Act governs the taxation of stock option plans. This subsection has often been used by the CRA to deny the deduction of the value of treasury shares issued under stock bonus plans.

However, in Transalta Corporation v. At the end of the term Transalta would determine, in its sole discretionwhether and to what extent the award would be paid in cash or by the issuance of treasury shares. In each taxation year under appeal Transalta increased its stated capital account by an amount equal to the fair market value of the shares issued under the plan on the basis that the shares were issued for past service, and claimed a corresponding deduction for those amounts.

The Court found that the plan was explicitly discretionary and did not create legally binding rights or enforceable obligations, prior to the delivery stock based compensation expense tax deductible canada the shares, to receive an award.

It therefore concluded that the plan was not caught by section 7, and the deductions were therefore not denied by subsection 7 3.

Although the CRA has previously expressed the view that no expenses would be deductible whether in the form of a sale or issuance of shares with respect to any form of stock option or stock purchase stock based compensation expense tax deductible canada as a result of the application of section 7 see, e. ACCit may see the proposed addition of section Interestingly, however, that provision would not have applied to reduce the deductions taken in this case.

Employers that provide equity-based incentive plans that issue treasury shares on a discretionary basis may wish to review their plans with their advisors to determine the appropriate tax treatment.

A leading Canadian business law firm, Stikeman Elliott LLP has lawyers in five bmw performance parts canada across Canada as well as Barclays stockbroker isa charges this blog to your feeds or subscribe by email using the form below.

Home Pensions Tax Court of Canada permits employer deduction of fair market value of stock grant Tax Court of Canada permits employer deduction of fair market value of stock grant Posted on December 07, Carla Hanneman and Lyle Teichman - Equity-based incentive plans have in recent years become a common component of the compensation package for executive employees in Canada. Post a comment Fill out this form to add a comment to the discussion.

The taxation of stock options | The tax planning guide

NameEmail AddressWebsite optional. About Us A leading Canadian business law firm, Stikeman Elliott LLP has lawyers in five offices across Canada as well as Topics Employment Employment Standards Human Rights Labour Pensions Termination Archives.

Subscribe Add this blog to your feeds or subscribe by email using the form below. Alberta's Fairly Family Friendly Employment Reforms and Curious Labour Changes The Saga Continues: The Ontario Court of Appeal strikes down a termination provision in Wood v.

Fred Deeley Imports Ltd.

Toronto Commerce Court West Bay Street. Ottawa Suite 50 O'Connor Street. Calgary Bankers Hall West - 3rd Street S. Vancouver Suite Burrard Street.

Stock Options & Taxes 1D -- Incentive Stock Options (ISOs)New York Park Avenue 7th Floor. London Dauntsey House 4B Frederick's Place. Sydney Level 12, Suite 1 50 Margaret Street.