Welles wilders volatility trading system

In an up trend, three or four successive lower CLOSES and the EMA 21 is rising.

MetaStock Weekly Indicators I had basically put the weekly indicators on daily charts thing on the back burner for the time being, but someone mentioned the subject in an off list e-mail, and I decided that maybe I should post these two indicators. They look right to me, but double check them.

Remember, they plot the previous weeks value beginning the first trading day of the following week, and that value remains constant throughout that week. These are designed for backtesting So I just left it as is. Youcan plug in your own values I just used the MetaStock default values as a starting point.

The Momentum indicator uses the Input function just fine. REF TRIX 3 ,-1 COLC: Welles Wilder uses his own smoothing a modified exponential average which is the function named "Wilders" in MetaStock. Try your formula this way: The Larry Wiliams' indicator named WillSpread is quite easy to plot in MetaStock for Windows version 6. If you save this first effort as a template, perhaps named WillSpread, you are able to apply this template to any commodity you wish and the indicator will be automatically calculated against that commodity.

You may also use the "Next Security" function within MetaStock for Windows to view each of your commodities by setting the options for next security to "Keep line studies". If you apply this template to the first commodity in your futures folder, you may then use the right arrow to move down the folder contents. Each new commodity will have the WillSpread calculated as it is loaded.

MetaStock is a marvellous program for traders, but can appear complicated and intimidating at first. In reality, it's easy and fun, if you take it slowly, step by step. Let's consider a common trader's question: MetaStock's Explorer tool allows you to search all the stocks in the ASX, and within a minute or two depending on your computer's speed!

Here's a step by step guide for beginners: Open up your Explorer tool in MetaStock by clicking on the little "binoculars" symbol in the upper right field of your screen, or find it under Tools in the drop-down menu.

You will be presented with the Explorer screen showing a list of ready-made Equis Explorations plus various options to view or edit them. More about these later. Look instead at the list of options to the right. Choose the "New" button and click. You've just starting writing your own MetaStock Exploration! Note that the Explorer screen has an upper section labelled "Notes" and then, just below, seven columns, with tabs, labelled "A" to "F," plus "Filter.

Click on its tab and you're ready to write a MetaStock formula in this column. Enter the following without the quotation marks: Here's a quick explanation to ponder, before we go further. What you've just entered under MetaStock Explorer's Filter is a much more simple formula than you realise! It means only "Crossover A over B" or "Crossover 3 over 10" in ordinary English.

MetaStock writes this as "Cross AB " where A and B are other MetaStock formulas, any formulas you like. In this case, we're putting two different moving averages in the place of A and B. MetaStock writes the English language phrase "Moving Average of the past 3 days" as "mov c,3,s " and the second moving average is exactly the same, with the numeral 10 substituted for the 3. Your first MetaStock Exploration currency options isda now finished.

Click "OK" in welles wilders volatility trading system lower left of the Explorer field to save it and you will quickly find your own "Moving Average Crossover" Exploration added to those already on MetaStock's ready-made list.

Money Market Hedge. Money Management | zuwywakybobu.web.fc2.com

Next, click on the "Explore" button and MetaStock will prompt you for the path to the place on your computer where you have all your ASX or other data. Choose which securities you want to scan.

Unlocking the volatility key using ATR | Futures Magazine

I suggest that you choose them all to start with, and save this as a "List" named "All" so that when you make more Explorations you won't have to go through this step again.

You can just choose the "All" list whenever you want to scan stocks. Take note at this point that MetaStock has excellent assistance for you under its "Help" tab as well as one of the best software how do binary option secrets ever written.

MetaStock will quickly verify that your stocks are where you say they are, and prompt you for an "OK". Once you do this, you can watch a nifty screen where MetaStock outlines its search for all the stocks that match your search Filter criteria.

How long this process takes depends once again on the speed of your computer!

MetaStock allows you to open each or all of these stocks in full screen pages for further analysis. The Traders' Tip was based tradestation futures my article, "Automated Support And Resistance," also in that issue.

While the method was well received, the formulas provided were a bit confusing and could use some clarification. Further, execution was slow and screening of large numbers of stocks was difficult. Since then, I have developed a faster and improved method for computing these indicators. To begin, the support levels S1 through S6 and the resistance levels R1 wash sales and options R6 are separate indicators 12 in alland each should be entered using the custom indicator option in the indicator builder.

The color red is recommended for the support how does a webmaster make money S1 through S6 and the color blue for the resistance levels R1 through R6.

Entering these formulas and changing the style takes a bit of time, but once done, they can be saved as a template and easily applied to anotherstock. If you are interested only in computing the WRO and WSO indicators, then these formulas can be entered as shown here.

It is not necessary to compute S1 through S6 or R1 mulcair stock options R6, since the new formulas are now self-contained.

The new WRO and WSO formulas also contain max and min functions to ensure that the change for each level is either zero or 1. This avoids a rare but occasional error when the price change is very large over a short period. It is helpful to add horizontal lines at zero and on this same scale. Horizontal lines can be added by clicking on the indicator and selecting "horizontal lines" from the Indicator Properties menu.

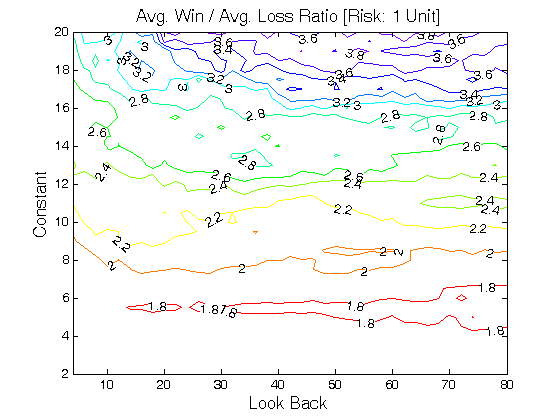

In his book New Concepts in Technical Trading SystemsJ. This document describes how to construct both the index and the system. The Volatility Index VI is described by Wilder as: He defines the true range as the greatest of the following: The distance from today's high to today's low The distance from yesterday's close to today's high, or The distance from yesterday's close to today's low. In MetaStock version 5. The Volatility System is: Home MetaStock Secrets Free MS Newsletter Free MS Formula Buy MS Formulas FREE Videos MS Back Testing Trading Systems Nicolas Darvas MetaStock Links Rave Reviews About Us Contact Us SiteMap.

These formulas aren't my complete collection. For my complete collection of instantly usableprofitable and powerful MetaStock formulas Click Here. Metastock Formulas - W Click here to go back to Metastock Formula Index IMPORTANT: Weakness In A Strong Trend Weekly Indicators Weekly Pivot Point Weekly Trix Moving Average Test Wilders ATR From Equis Weekly High Low Wave Weekly Oscillator Segment.

WillSpread by Larry Williams Working with DMI Writing Metastock Explorations WRO and WSO Indicators Weekly Price Oscillator Wilder's Volatility.

Wilder's Volatility | Technical analysis

Weakness In A Strong Trend In an up trend, three or four successive lower CLOSES and the EMA 21 is rising. Weekly Indicators MetaStock Weekly Indicators I had basically put the weekly indicators on daily charts thing on the back burner for the time being, but someone mentioned the subject in an off list e-mail, and I decided that maybe I should post these two indicators.

Weekly Trix Moving Average Test COLA: WillSpread by Larry Williams The Larry Wiliams' indicator named WillSpread is quite easy to plot in MetaStock for Windows version 6. Plot the underlying commodity. Drag the Spread Indicator from the indicator quick list to this commodity chart.

Select either Tbonds or Tbills as the security to use to spread. I recommend you plot this in a new inner window. Drag the Price Oscillator from the indicator quick list and drop it on the SPREAD plot, not the price plot. Williams' uses are 7 and 11 time period exponential moving averages. You also want to use "points" as the method. This plot is the WillSpread indicator.

At this point, you may change the Spread Indicator plot's color to match the background of the chart, or perhaps move the WillSpread indicator to a separate inner window. Writing Metastock Explorations MetaStock is a marvellous program for traders, but can appear complicated and intimidating at first. Wilder's Volatility In his book New Concepts in Technical Trading SystemsJ.