Earn forex elliott wave

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy.

Most Forex traders base their decisions on technical analysis. This type of analysis identifies market patterns and trends based on complex mathematical equations, which are combined and placed into the form of a certain indicator. Various traders employ different indicators in their trading setups, yet there are some indicators that are commonly used.

Elliott Waves, often abbreviated to EW, is one of these well known indicators. It is so popular that it actually occupies its own niche in Forex trading analysis. In this article, we will provide an overview about the history of the indicator and its development, and also explain how to use it.

We will then discuss how to apply the EW oscillator, while supplying you with useful links for further reading about wave analysis. Ralph Nelson Elliott was founder of this theory and invented the mechanism of Elliott Wave.

This term refers to the particular pattern or trend followed by the stock market, which occur in repetitive in trade cycles. It all started in the s when Ralph Nelson Elliott highlighted specific patterns of market prices. From this work, market practitioners came up with the name Elliott Wave. This methodology is not about calculations; rather it looks at the historical trends of the financial markets, working on the premise that history repeats itself.

With this in mind, advocates of this theory believe that a comprehensive presentation of the market can be represented with the help of wave analysis Forex. So why do these repetitive trade cycles occur?

It's because of the mass psychology of the financial markets. Investors that trade within these markets broadly share the same hopes and anxieties, meaning they often react as a 'herd' to economic news events. As a result, prices within these financial markets - including Forex - suffer from upward and downward swings known as waves. Elliott Wave shows that investor psychology is the real engine behind movements in the financial markets.

This is why it is used in Forex trading - to produce more understandable and profitable results. Using Elliott Wave to trade the Forex markets is also known as Elliott wave analysis or Forex wave analysis. Forex Elliott wave is often used by traders and Forex investors as one of many Forex advanced strategies.

Broadly speaking, here is how many professionals approach EW in Forex trading:. Hence, Forex Elliott Wave analysis can affect Forex trading in a myriad of ways.

This means that there are multiple ways to interpret Elliott Wave analysis. It depends on the requirement and choice of the Forex trader as to what method of FX wave analysis they follow.

Having said that, it does not matter all that much what variation of Forex Elliott Wave analysis a trader follows. What matters is their ability to attentively follow its trading rules, which include:. Experts have always encountered difficult periods when trading Elliott Wave analysis.

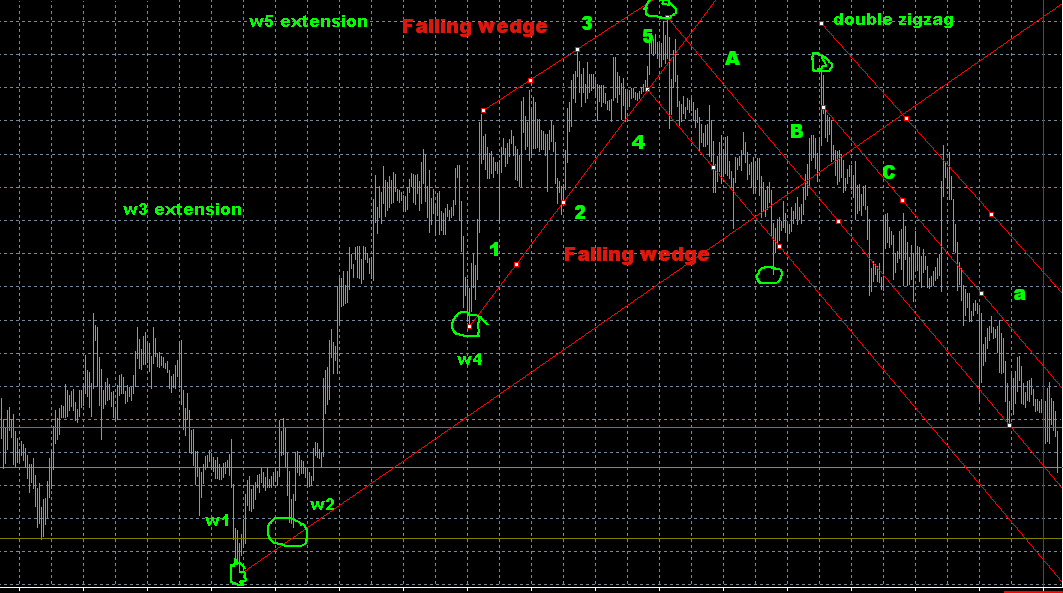

The high degree of subjectivity involved in applying this methodology, is most probably the reason for its mixed success rate. This is the reason why it is strongly advised to learn Elliott Wave Forex analysis in some detail. The Elliott Wave analysis Forex includes two different wave patterns, which include the five wave pattern, as well as the three wave pattern.

Elliott Wave Theory | Forex Earn

The five wave pattern can be found with five different dominant waves, which include Wave 1, Wave 2, Wave 3, Wave 4 as well as Wave 5.

The other corrective trend includes other three wave patterns, including Wave A, Wave B, as well as Wave C. All of these waves make up for arranging the best results in market analysis. There are certain principles that come up with the influence of Elliott Wave Forex analysis. Some of them are mentioned below:. It goes without saying that this indicator can be useful for many traders.

Yet, it is important to understand that it is still just a theory that is not proven. This is why there are many traders that simply disregard EW in their trading strategy.

Nevertheless, EW has been an important indicator not only in Forex analysis, but also in stock trading. EW may not necessarily be beneficial for you, yet you can only find out by the application of it in your trading strategy. But how can traders combine EW with other Forex indicators? In general, EW is just a supportive indicator that can give you a good overview on the market and its potential moves, along with correct placement of stop-losses and take-profits.

However, it does not provide exact entry and exit signals. This is why this supportive indicator is recommended to be used together with other indicators that can be used better for identifying the points of entering and exiting the trades.

Hence, EW should rather be used for confirmation than identification. Let's see what indicators combine well with EW. MACD, which is also known as Moving Average Convergence Divergence, is one of the most popular indicators with starters. The good news is that it goes quite well with EW.

The best application of the combination of these indicators is by monitoring the appearance of the third wave of Elliott. Another great and easy indicator that goes well with Elliot Wave is Relative Strength Index. With the combination of these indicators, you can predict how strong the future moves could be.

If you are trading Forex, most probably your trading platform is MetaTrader 4. Here we are going to explain where to find EW at MT4 and how to apply it. As a rule, you would need to have MetaTrader 4 before you can actually apply EW.

If you don't have one, apply for a Demo Account here to get access to an account preloaded with virtual money. Once you have downloaded and installed MetaTrader 4, you need to login to the platform. After that, you would need to select 'Indicators' and then choose 'Oscillators'. Under this category, you will be able to find EW. Analysis of market behaviour can never be made easier with Forex Elliott Wave analysis alone.

So utilisation of statistics, with the help of Elliott Wave analysis in Forex trading, is highly recommended.

So if you are looking for an easy way to confirm market behaviour, make sure you understand Elliott Wave. We hope that this article has been useful for you. EW is a great way to boost up your knowledge and understanding of Forex trading - and to generally understand the market's behaviour a little better. The best way to see practical use of EW is actually by trying it out on your trading platform.

This indicator is not so easy to use, yet it is quite useful to have it as a part of your trading setup. We would not recommend you to solely rely on EW, it should be a secondary or a conformational indicator to an already developed trading strategy. Should you find the application of EW indicator difficult, you can always find help or inspiration at Admiral Markets wave analysis section. In this section, you will have the analysis supplied on daily basis on H1 and H4 time frames.

If you are trading on different time frames, it will be still useful for you to preview the analysis and understand how you can improve your own EW analysis.

Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using Admiral Markets UK Ltd services please acknowledge the risks associated with trading.

The content of this Website must not be construed as personal advice. Admiral Markets UK Ltd recommends you seek advice from an independent financial advisor. Admiral Markets UK Ltd is fully owned by Admiral Markets Group AS. Admiral Markets Group AS is a holding company and its assets are a controlling equity interest in Admiral Markets AS and its subsidiaries, Admiral Markets UK Ltd and Admiral Markets Pty. All references on this site to 'Admiral Markets' refer to Admiral Markets UK Ltd and subsidiaries of Admiral Markets Group AS.

Admiral Markets UK Ltd. Clare Street, London EC3N 1LQ, UK. About Us Why Us? Regulatory Authorisation Admiral Markets UK Ltd is regulated by the Financial Conduct Authority in UK. Contact Us Leave feedback, ask questions, drop by our office or simply call us. Partnership Enhance your profitability with Admiral Markets - your trusted and preferred trading partner.

Careers We are always on the lookout to add new talent to our international team. Press Centre Get the latest Admiral Markets press releases and find our media contacts in one place, whenever you want them Order execution quality Read about our technologies and see our monthly execution quality report. Account Types Choose an account that suits you best and start trading today. Top products Forex Commodities Indices Shares Bonds. Contract Specifications Margin requirements Volatility Protection.

Learn more about this plugin and its innovative features. MT4 WebTrader Use MT4 web trading with any computer or browser no download necessary. Fundamental Analysis Economic events influence the market in many ways. Find out how upcoming events are likely to impact your positions.

Elliott Wave Analysis by EWF | Page 7 | Forex Forum - EarnForex

Technical Analysis Charts may show the trend, but analysis of indicators and patterns by experts forecast them. See what the statistics say. Forex Calendar This tool helps traders keep track of important financial announcements that may affect the economy and price movements. Autochartist Helps you set market-appropriate exit levels by understanding expected volatility, impact of economic events on the market and much more.

Trader's Blog Follow our blog to get the latest market updates from professional traders. Market Heat Map See who are the top daily movers.

5 AWESOME ways to ride the trend with ELLIOTT WAVE.

Movement on the market always attracts interest from the trading community. Market Sentiment Those widgets help you see the correlation between long and short positions held by other traders.

Learn the basics or get weekly expert insights. FAQ Get your answers to the frequently asked questions about our services and financial trading. Trader's Glossary Financial markets have their own lingo. Learn the terms, because misunderstanding can cost you money.

Held by trading professionals. Risk Management Risk management can prevent large losses in Forex and CFD trading. Learn best-practice risk and trade management, for successful Forex and CFD trades. Zero to Hero Start your road to improvement today. Our free Zero to Hero program will navigate you through the maze of Forex trading. Forex Have you ever fancied giving trading a go? Check out our free online Forex education course and learn to trade in just 3 steps! Admiral Club Earn cash rewards on your Forex and CFD trading with Admiral Club points.

Play for fun, learn for real with this trading championship. Personal Offer If you are willing to trade with us, we are willing to make you a competitive offer.

About Us About Us Why Us? Introduction to Forex Elliott Wave analysis. Android App MT4 for your Android device. MT4 WebTrader Trade in your browser. MetaTrader 5 The next-gen. MT4 for OS X MetaTrader 4 for your Mac. Forex and CFD trading may result in losses that exceed your deposits.

Please ensure you understand the risks involved. Regulatory Authorisation Contact Us News Testimonials Partnership Careers Press Centre Order execution quality.

Products Forex Commodities Indices Shares Bonds Contract Specifications Margin requirements Volatility Protection. Platforms MetaTrader 4 MT4 Supreme Edition MT4 WebTrader MetaTrader 5. Analytics Fundamental Analysis Technical Analysis Wave Analysis Forex Calendar Autochartist Trader's Blog Market Heat Map Market Sentiment.